US stocks traded mostly in the green on Tuesday, looking to extend their two-day winning streak.

The Dow Jones Industrial Average inched up over 180 points, while the S&P 500 and Nasdaq Composite each rose 0.4%.

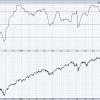

The Cboe Volatility Index (VIX) slid back below 30 after spiking to around 60 last week.

The corporate earnings season is set to intensify this week, with key reports from United Airlines and Netflix still to come.

Even with companies disclosing quarterly numbers, the actual financial and operational implications of the sweeping trade measures likely won’t materialize until later in the year.

For now, markets remain in wait-and-watch mode.

The tariff threat still lingers

Tuesday’s modest market moves followed a tech-led rebound on Monday, driven by relief over tariff exemptions.

Guidance from US Customs and Border Protection confirmed that electronics — including smartphones, computers, and semiconductors — would be spared from immediate reciprocal tariffs, giving risk assets room to recover.

However, remarks from President Trump and Commerce Secretary Howard Lutnick over the weekend indicated those carve-outs could be temporary, keeping markets on edge.

Despite the bounce, the three major indexes remain underwater relative to their levels before Trump’s tariff announcement on April 2.

The Dow and Nasdaq are still down over 3%, while the S&P 500 has lost more than 4%, underscoring the market’s struggle to stabilize in a volatile, policy-driven environment.

Earnings drive rally in major bank stocks

Bank of America jumped 4% after delivering first-quarter results that topped analyst expectations.

The bank reported an 11% increase in profit to $7.4 billion, or 90 cents per share, with revenue rising 5.9% to $27.51 billion for the quarter.

The performance was driven by a solid rise in net interest income, which reached $14.6 billion, narrowly topping the $14.56 billion estimate from StreetAccount.

Citigroup shares also advanced after the bank posted stronger-than-expected first-quarter results, buoyed by robust performance in its fixed income and equities trading divisions.

The stock was up around 2% in early trade.

The firm reported earnings of $1.96 per share on revenue of $21.50 billion, outpacing Wall Street estimates.

US import prices

US import prices slipped in March, declining 0.1% ahead of the rollout of President Trump’s broad-based tariffs, the Bureau of Labor Statistics reported Tuesday.

The drop was largely driven by a 2.3% decline in fuel prices. Economists polled by Dow Jones had expected no change.

On the other side of the ledger, export prices were unchanged for the month after a 0.2% increase in February.

The post US stocks climb higher on Tuesday: Dow jumps 180 points, Nasdaq up 0.4% appeared first on Invezz