US-listed spot Bitcoin exchange-traded funds (ETFs) recorded net inflows of $260.27 million, extending a trend of positive capital movement into digital asset products.

However, open interest has now dropped 5% to $29.47 billion, marking a slowdown from recent weeks as Bitcoin’s price struggled to break key resistance levels.

The pullback in inflows follows a month-long run of heightened institutional interest, with investors now appearing more cautious.

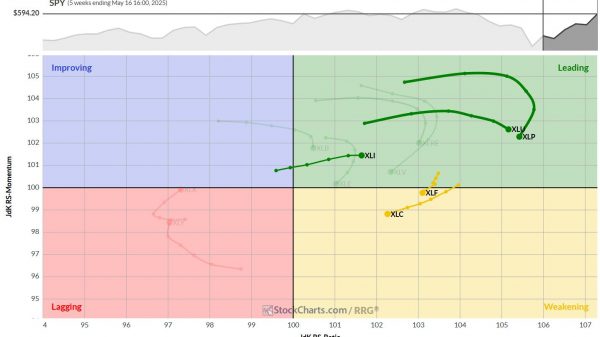

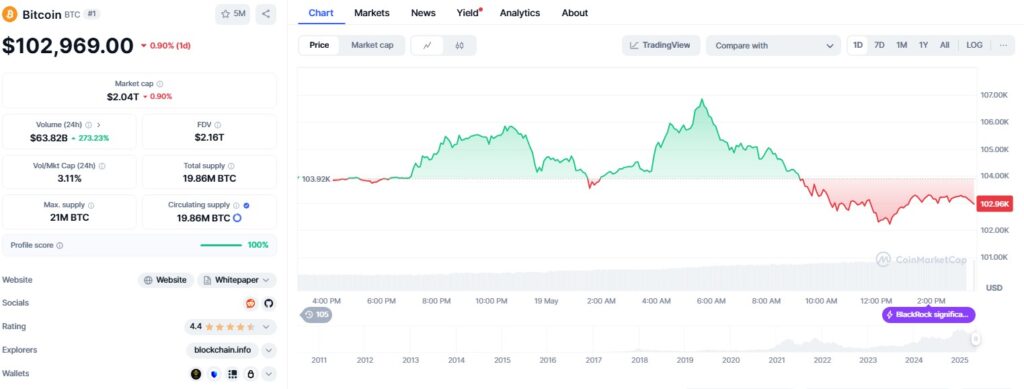

During the five-day period, Bitcoin remained rangebound, trading between $102,711 and $104,971.

This consolidation phase likely contributed to the softer demand for ETF exposure.

The lower inflow figure also reflects broader macroeconomic uncertainties, with traders reacting to global rate policies and mixed inflation data across key markets.

BTC trades sideways near $103K

Bitcoin’s lack of decisive price action has curbed some of the aggressive buying seen in prior weeks.

On 19 May, BTC briefly touched $107,108 before correcting and is now trading at approximately $102,969.

This suggests that despite occasional breakouts, strong overhead resistance is dampening short-term momentum.

While ETFs remain a key avenue for institutional crypto exposure, last week’s inflow of $260.27 million highlights tempered enthusiasm compared to previous weekly figures that crossed $900 million.

The technical indecision may be prompting investors to wait for a more defined trend before deploying fresh capital.

Market observers have also noted a shift in investor focus toward other altcoins and layer-2 projects, which have shown stronger relative strength in recent sessions.

Derivatives activity

Despite slower ETF inflows, data from the derivatives market points to ongoing bullish sentiment.

Futures open interest dropped 5% to $29.47 billion.

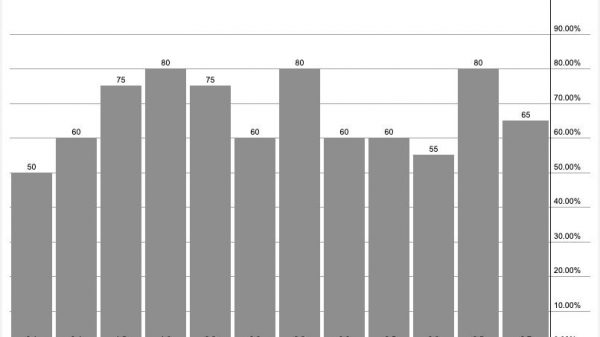

Options market data also reflects positive bias. On 16 May, demand for call options outweighed puts, indicating that traders are positioning for an upward move.

This suggests confidence in a possible short-term rebound above recent resistance, with some investors anticipating a push toward the $110,000 mark.

Still, analysts warn that leveraged positions may increase volatility, especially if BTC fails to hold above $100,000 in the coming days.

Resistance levels remain key to next move

Bitcoin’s near-term direction hinges on its ability to break through resistance around $105,000.

A convincing move above this level, supported by volume, could reignite ETF inflows and validate bullish positioning in the derivatives market.

Until then, institutional interest may continue to moderate.

Even with the recent dip in net ETF flows, the broader 2025 trend reflects growing institutional acceptance of Bitcoin.

Spot products have made it easier for asset managers to gain exposure without dealing directly with custody or regulatory complexities.

As BTC hovers near $102,969, the market awaits a clearer breakout or breakdown.

The next move could determine whether this consolidation is merely a pause in a longer uptrend or an early sign of a broader cooldown.

The post Bitcoin ETF open interest dips 5% to $29.47B as BTC holds near $102.9K appeared first on Invezz